This post is also available in:

![]() العربية

العربية

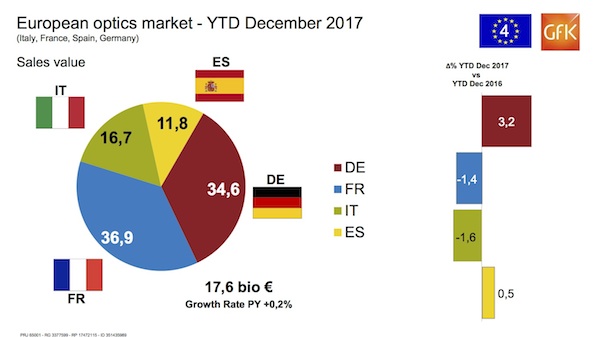

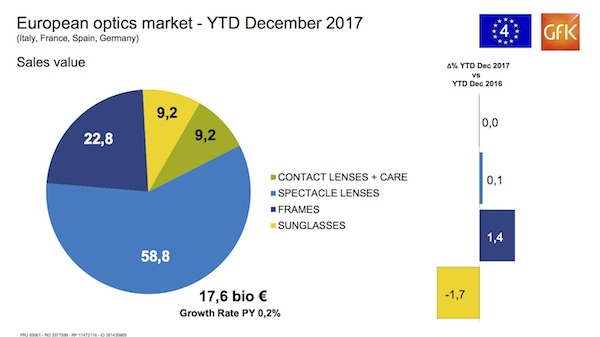

GfK has announced the latest figures for key European retail optics markets (Italy, France, Spain and Germany), registering a turnover of €17.6 billion for the year 2017 and a positive trend in value of 0.2 percent compared to the previous year

GfK has announced the latest figures for key European retail optics markets (Italy, France, Spain and Germany) as €17.6 billion for total year 2017 and a positive trend in value of 0.2 percent compared to the previous year.

GfK’s Optics Panel tracks sales data in the optician channel for sunglasses, frames, spectacle lenses, contact lenses and solutions for contact lenses.

2017 figures show a yearly moderate positive trend of 0.2 percent of the combined optical market of Italy, France, Spain and Germany, registering a total turnover of €17.6 billion.

The four countries register varied performances: France continues to represent the biggest slice of the Europe 4 market aggregation (36.9 percent) but, together with Italy, the trend is negative: -1.4 percent for France and -1.6 percent for Italy.

Germany is sharply positive (+3.2 percent) and with this performance is able to make of for the loss of other countries and keep Europe 4 aggregation almost stable / slightly positive.

Spain is also slightly positive (+0.5 percent).

Category Overview

By looking at the category performances, only spectacle frames are showing a positive trend (+1.4 percent) while sunglasses continue to show a decline (-1.7 percent) and the vision care aggregation (contact lenses and care products) are purely flat. Finally, the vast majority of the business is still hold by the spectacle lenses market (58.8 percent) which shows a flat performance (+0.1 percent).

Focusing more in detail on the flat performance of the spectacle lenses market, it is actually covering different scenarios at single country level. Germany is extremely positive (+3.9 percent) and also Spain is showing a positive trend (+1.3 percent), while France and Italy are undoubtedly negative (respectively -2.3 and -3.4 percent).

France’s negative performance is reflecting recent changes in government legislation, which limit the reimbursement of eyewear to €150 and reduce the frequency of renewal for spectacle glasses from one to two years.

In Italy, monofocal lenses are negative and progressive lenses tend to migrate slightly to cheaper products with consequent decline in value.

The vision care market is also the result by different trends: the overall trend for care products for contact lenses is negative (-3.7 percent) but this is counterbalanced by the largely good performances of daily lenses (+5.4 percent).

The sunglasses market is more and more driven towards the “entry level” part of the business owing to the significant growth of private labels below €80. Thus the contraction in value.

On the contrary spectacle frames, which are the top performers in the optics business, are showing a growing tendency towards the upper part of the market.

Why the sudden hike?

The last 12-18 months have been heavily marked by a process of strong vertical integration – both at manufacturers and retail level. This evolving scenario is bringing new challenges and GfK is actively supporting leading players within the optics industry in 30 countries around the world.

Reflecting the evolution of client requests, GfK is also further expanding our geographical presence: this year they will be opening Portugal soon followed by Belgium, thus completing our comprehensive coverage of the European region. The brand’s service portfolio will be also enriched by adding high value services such as Fit Audit tracking (a consumer program for contact lenses) which it is launching in Russia and soon in France and Japan.

-Gianni Cossar, GfK’s Global Director for Optics and Eyewear